Bitcoin continues to dominate global financial headlines as investors closely track its price movements and future potential. Recent Google Trends data and market reports show growing interest in Bitcoin forecasts, especially as the cryptocurrency faces both bullish predictions and short-term volatility. The big question remains — can Bitcoin break new all-time highs soon?

Current Bitcoin Price Trends

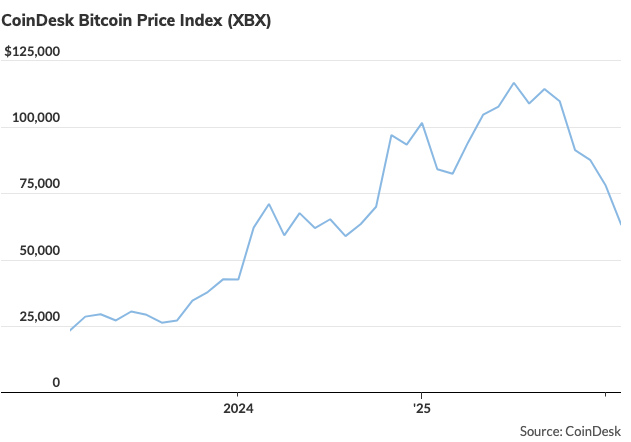

Bitcoin has experienced significant price swings in recent months, reflecting the highly volatile nature of the crypto market. According to recent market analysis, Bitcoin has faced sharp corrections, with prices falling considerably after reaching record highs in late 2025.

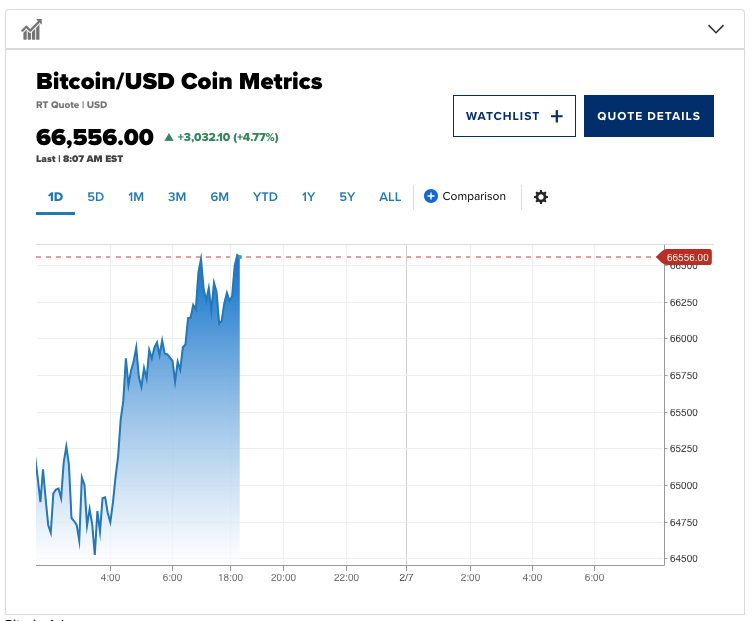

At the same time, trading data shows Bitcoin still holding strong support levels, with resistance zones that could trigger upward momentum if market sentiment turns positive. This mixed trend explains why Bitcoin continues to remain one of the most searched financial assets worldwide.

Bullish Predictions: Why Experts Expect New Highs

Despite short-term price fluctuations, many institutions and crypto experts remain optimistic about Bitcoin’s long-term growth. Several forecasts suggest Bitcoin could reach between $150,000 and $200,000 in the coming years, driven mainly by institutional investments and increasing regulatory clarity.

Major financial institutions have also issued strong projections. Some banks estimate Bitcoin could reach approximately $150,000 by 2026 if ETF investments and adoption continue expanding.

Additionally, asset management firms believe Bitcoin could potentially achieve new all-time highs during market cycles fueled by economic uncertainty and growing demand for alternative stores of value.

These predictions highlight a growing belief that Bitcoin is shifting from a speculative asset toward a more established investment option.

Bearish Risks: What Could Slow Bitcoin’s Growth?

While optimism remains strong, several risks could delay Bitcoin’s path toward new record highs. Analysts warn that Bitcoin still faces heavy price corrections due to market liquidation, macroeconomic pressure, and changes in investor sentiment. Some projections even suggest Bitcoin could drop significantly if major support levels fail.

Economic factors such as interest rate changes, inflation control policies, and global financial instability can also influence Bitcoin’s demand. Additionally, slower institutional inflows and reduced corporate investments may limit rapid price growth in the short term.

Long-Term Outlook: A Growing Digital Asset

Long-term Bitcoin forecasts remain largely positive. Some research firms suggest Bitcoin could reach extremely high valuations over the next decade as adoption increases globally. In fact, certain projections estimate Bitcoin may exceed $250,000 by 2027 if institutional demand and technological innovation continue strengthening the crypto ecosystem.

Although these forecasts vary widely, they demonstrate growing confidence in Bitcoin as a major financial asset rather than a short-term investment trend.

Will Bitcoin Break New All-Time Highs Soon?

The possibility of Bitcoin reaching new all-time highs largely depends on market sentiment, regulatory developments, and global economic conditions. While short-term volatility is expected, long-term forecasts suggest Bitcoin still holds strong potential for future growth. Investors are closely monitoring institutional adoption and macroeconomic trends, as these factors could play a crucial role in shaping Bitcoin’s next major price rally.

Final Thought

Bitcoin remains one of the most unpredictable yet promising assets in the financial world. While market corrections may create temporary uncertainty, long-term adoption and technological advancement continue to support Bitcoin’s growth potential. Investors should focus on market research and risk management rather than short-term speculation.

You might also like

- Bitcoin Price Forecast: Will BTC Break New All-Time Highs Soon?

- The Lincoln Lawyer Season 4 Updates: Everything you need to know about it

- Pizza Hut Location Search: How to Find Out if Your Neighborhood Store is Shutting Down

- Ultimate 2026 Alton Towers Guide: New Rides, Best Attractions & Insider Tips

- Everything You Need to Know About the McDonald’s Friends Meal (2026 Guide)

Disclaimer

This article is for informational and educational purposes only and should not be considered financial or investment advice. Cryptocurrency investments involve significant risk, and readers should conduct independent research or consult financial professionals before making investment decisions.

#Bitcoin #BitcoinPrice #CryptoMarket #BTCForecast #Cryptocurrency #BitcoinPrediction #CryptoInvestment #BlockchainTechnology #Carrerbook #Anslation

Tags: Anslation, Bitcoin, BitcoinPrediction, BitcoinPrice, BlockchainTechnology, Carrerbook, Cryptocurrency, CryptoInvestment, CryptoMarket