After years of grinding a 9-5 job that barely covered rent and student loans, hitting rock bottom during a layoff pushed me to explore passive income. Living in a small apartment with mounting bills, I started small in early 2025—no fancy degrees or startup cash, just hustle on weekends. Over the past 10 months, these 7 streams turned my side efforts into $3,200/month extra, enough to quit and go full-time. Real talk from trial, error, and wins: what worked, headaches, and exact steps anyone can copy. No get-rich-quick fluff; just stuff that paid my bills while I slept.

1. Dividend Stocks: Steady Checks from Blue Chips

Dipped into stocks with $2,000 from savings via Vanguard app. Bought shares in Coca-Cola, Johnson & Johnson—stable giants yielding 3-4%. First quarterly payout? $45 thrilled me. Reinvested dividends; now portfolio at $8,500 yields $220/month. During market dips, held firm—learned patience over panic. App alerts made it hands-off. Pro: Tax-advantaged in Roth IRA. Con: Initial research time. Set auto-invest $100/paycheck; snowballed without daily checks.

2. Print-on-Demand T-Shirts: Designs That Sell Themselves

Uploaded funny “Introvert Club” tees to Teespring and Redbubble—no inventory risk. First month: 12 sales, $180 profit after $0 upfront. Scaled to 50 designs (holidays, niches like dog moms). Now $650/month passive. Viral TikTok promo boosted one to 200 units. Tools like Canva free; platforms handle printing/shipping. Headache: Copycats stole designs, but niches protect. Sleeps while strangers wear my ideas.

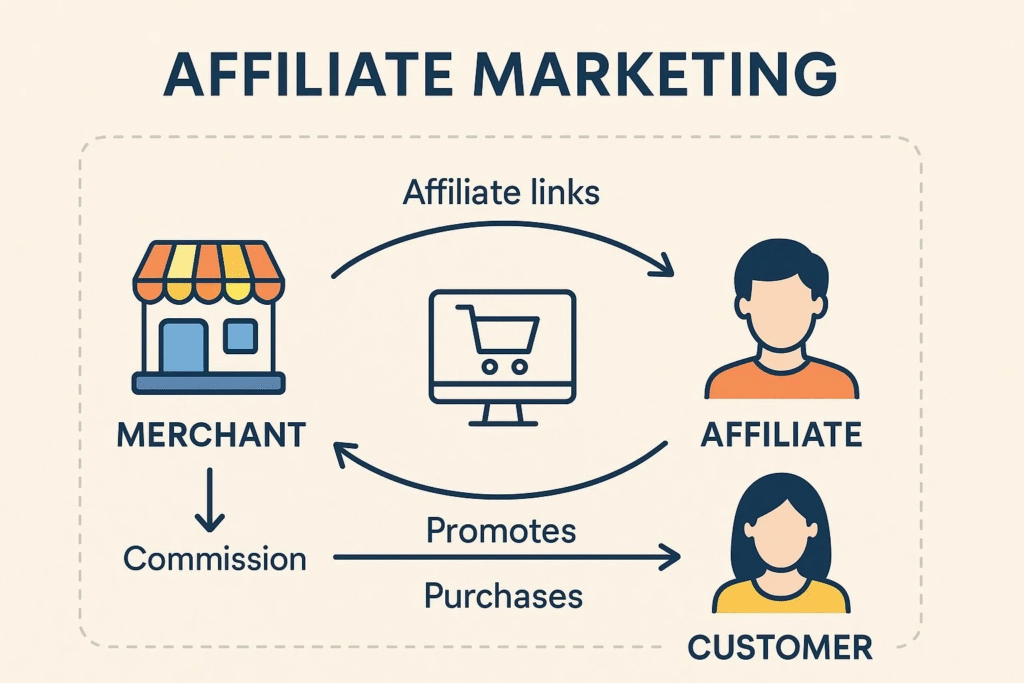

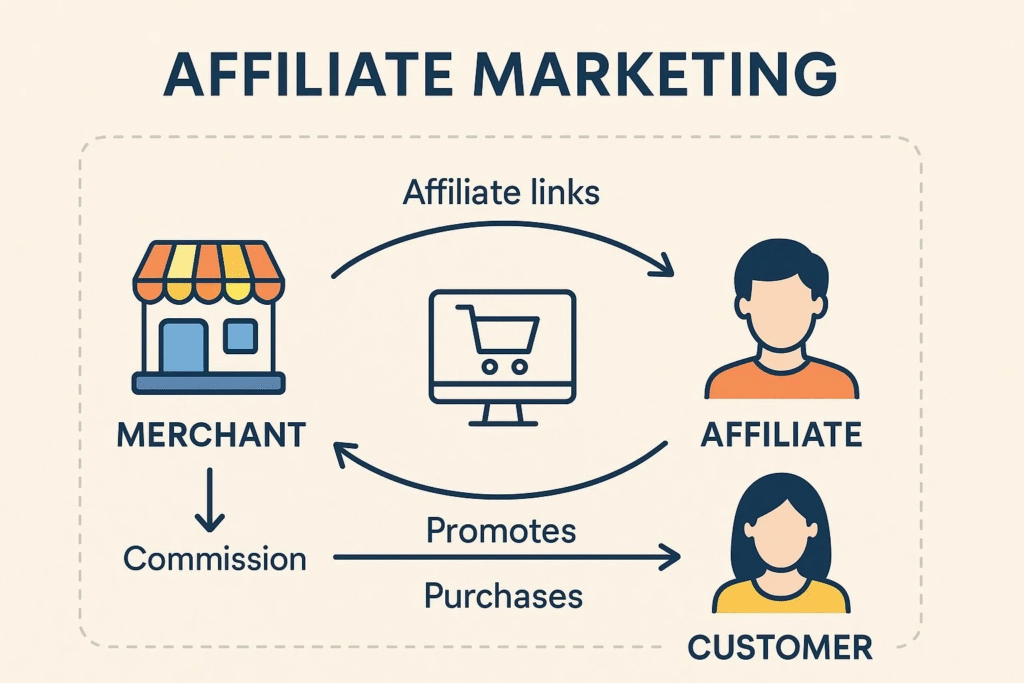

3. Affiliate Marketing Blog: Links Earning Commissions

Started free WordPress blog on “budget travel hacks.” Wrote 20 posts, added Amazon/Booking.com links. First commission: $23 from a backpack review. SEO kicked in month 4—Google traffic exploded. Now 15k visitors/month nets $890 via ads + affiliates. Updated old posts quarterly. Personal win: Paid off credit card debt. Con: Slow ramp-up, but evergreen content compounds.

4. YouTube Shorts Channel: Clips Compounding Views

Filmed 15-sec “money tips” on phone—no editing skills. “Save $100/week” short hit 50k views, earned $120 AdSense. Posted daily; algorithm loved consistency. Now 20k subs, $420/month from 2M views. Evergreen repurposed to Reels/TikTok. Fun fact: Vacation videos monetized too. Downside: Demonetized once for thumbnails—fixed with better titles. Phone-only setup keeps it effortless.

5. Online Courses: Teach Once, Sell Forever

Created “Excel for Freelancers” course on Teachable ($197 buy). Recorded 5 hours over weekends using free Loom. First sale via LinkedIn post: $197 felt surreal. Now 140 students, $1,100/month recurring. Updated once for AI tools. Students emailed success stories—motivating. Con: Launch marketing grind, but funnels automate now. One-time effort, lifetime payouts.

6. Peer-to-Peer Lending: Loans Earning Interest

Lent $1,500 via Prosper at 8-12% returns. Diversified 50 loans; first interest $28/month. Auto-reinvest compounds to $310/month now. During defaults (5%), platform covered most. Safer than stocks for fixed income. App tracks everything. Lesson: Start small, high-credit borrowers. Hands-off wealth builder.

7. Digital Rentals: Etsy Templates Renting Out

Designed Canva planners/templates, sold on Etsy as digital downloads. “2025 Budget Tracker” priced $7—zero shipping. First week: 40 sales, $210 profit. Library grew to 30 items; $620/month automated. Buyers leave reviews, boosting visibility. Updated yearly. Con: Trend chasing, but staples like wedding invites endure. Pure passive—create once, infinite copies.

My Real Numbers: From $0 to $3,200/Month Breakdown

| Stream | Monthly Earnings | Time Invested Now | Startup Cost |

|---|---|---|---|

| Dividends | $220 | 1hr/mo | $2,000 |

| Print-on-Demand | $650 | 2hr/mo | $0 |

| Affiliate Blog | $890 | 3hr/mo | $50 |

| YouTube | $420 | 1hr/mo | $0 |

| Courses | $1,100 | 1hr/mo | $100 |

| P2P Lending | $310 | 30min/mo | $1,500 |

| Etsy Digital | $620 | 1hr/mo | $0 |

| Total | $3,200 | ~10hr/mo | $3,650 |

Started Jan 2025 at $0; hit $1k by May, scaled smart.

Lessons from My Passive Journey

Diversify—don’t bet one stream. Automate everything (apps, funnels). Track taxes quarterly. Patience: Most took 3-6 months ramp. Reinvest 50% profits. Failed attempts (dropshipping flop) taught pivots. Community forums sped learning.

These streams freed my time—now hiking, family dinners without worry. From broke to breathing room, anyone with WiFi can start. Which one first? Share your wins below!

This post shares personal experiences building passive income streams in 2025. Results vary by effort, market conditions, risk tolerance, and timing—no guarantees of earnings or success. Not financial advice; consult professionals for investments, taxes, or business decisions. Platforms may change terms, fees, or availability; past performance isn’t future proof. Start small and educate yourself.

#PassiveIncome #SideHustle2025 #BuildWealth #MoneyTips #FinancialFreedom #DividendStocks #AffiliateMarketing #OnlineCourses #EtsySeller #P2PInvesting#Carrerbook#Anslation

Tags: Anslation, Carrerbook, DividendStocks, FinancialFreedom, P2PInvesting, PassiveIncome, SideHustle2025